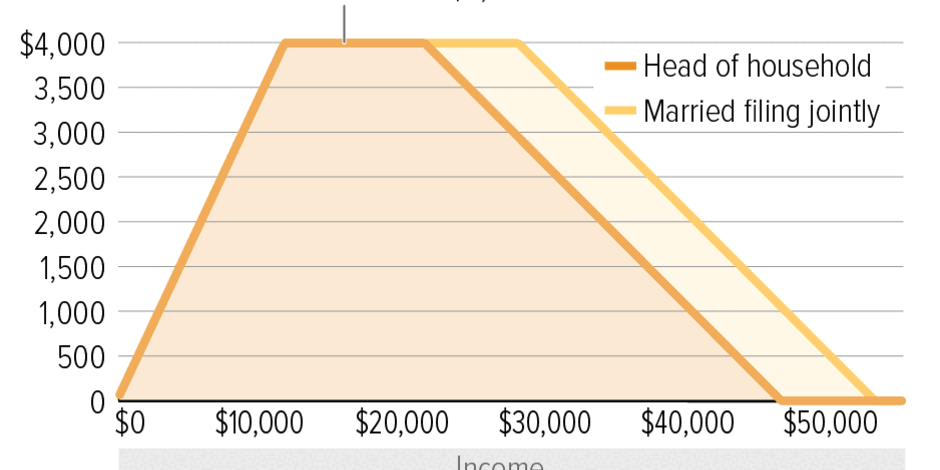

Earned Income Tax Credit 2024 – The earned income tax credit (EITC) is a valuable tax credit that many taxpayers normally miss. Historically, 1 in 5 eligible Americans don’t claim the EITC, prompting the Internal Revenue Service to . Awareness Day and Jackson Hewitt Tax Services® wants to ensure more taxpayers know about this often overlooked, but highly valuable tax credit that can reduce taxes owed and increase refunds. .

Earned Income Tax Credit 2024

Source : www.cpapracticeadvisor.com

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Maximum Earned Income Tax Credit for 2024 #eitc #credit #irs #2024

Source : www.tiktok.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS Announces 2024 Income Tax Brackets. Where Do You Fall

Source : drydenwire.com

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

What Is the Earned Income Tax Credit?

Source : www.pgpf.org

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Earned Income Tax Credit 2024 Here Are the 2024 Amounts for Three Family Tax Credits CPA : But often refunds for e-filed returns are issued in less time than that. A key exception: Taxpayers claiming the earned income tax credit or the additional child tax credit aren’t able to get a refund . Nonprofit partners on the Peninsula want to make sure low- and middle-income workers know how to qualify for the earned income credit this tax season. The Hampton Roads Community Action Program and .